Thursday, 18 December, 2025 - 08:00 to 20:00 Paris time

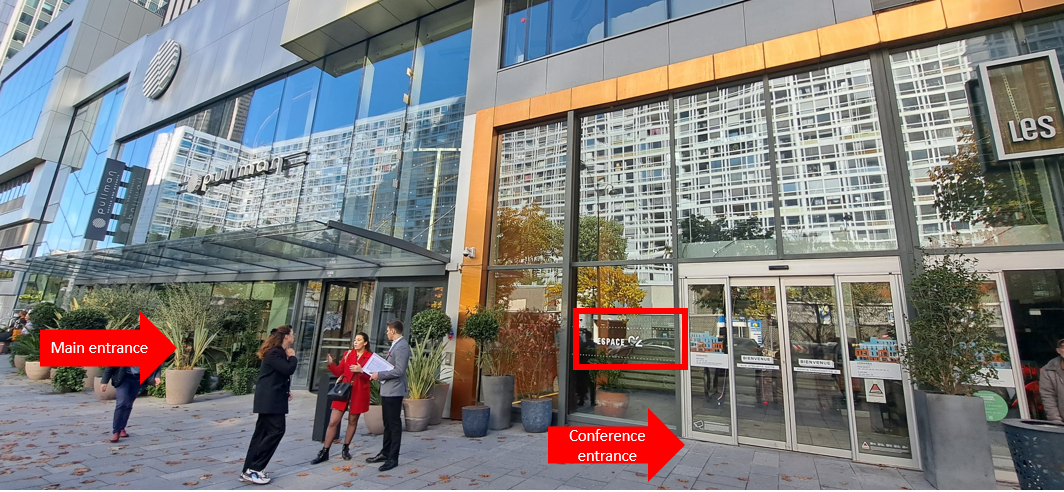

Pullman Paris Montparnasse Hotel - PARIS, FRANCE

Presentation

The EUROFIDAI-ESSEC Paris December Finance Meeting will hold its 23rd edition in-person in downtown Paris (Pullman Paris Montparnasse Hotel) on December 18, 2025.

The conference is organized by EUROFIDAI (European Financial Data Institute) and the ESSEC Business School and jointly sponsored by Amundi / PLADIFES / CDC Institute for Economic Research / Clipway.

All researchers are invited to present in English their latest research in all areas of finance. Job market papers are welcomed and integrated in normal sessions. They will be highlighted in the program.

In recent years, the conference has become very selective with one in six submitted papers accepted. The EUROFIDAI-ESSEC Paris December Finance Meeting is ranked 2nd in Europe and 8th in the World among large conferences based on papers published in the Top3 Finance and Top5 Economics journals « Ranking Finance Conferences: An Update by W. Hou, E. Smajlbegovic and D. Urban (Erasmus University Rotterdam) - February, 2025 ».

Prizes will be awarded for the Best Conference Paper and the Best Job Market Paper.

Timeline

- Submissions opening: March 31, 2025

- Submissions deadline: June 1, 2025

- Notice of acceptance: early July, 2025

- Registration deadline for accepted authors: July 20, 2025

- Online Program: October, 2025

- Registration deadline for other participants: December 5, 2025

Statistics

In 2024, the submissions were received from 31 different countries:

In 2024, the submissions were received from 31 different countries:

The U.S (82), The U.K. (45), France (41), Germany (35), Canada (27), China (26), Switzerland (20), the Netherlands (18), Australia (13), Denmark (11), Italy (11), Austria (7), Singapore (7), Finland (6), Hong-Kong (6), South Korea (6), Sweden (5), Norway (4), Belgium (3), Luxembourg (3), Spain (3), Ireland (2), Taiwan (2), Portugal (1), Greece (1), Israel (1), Lebanon (1), Colombia (1), Liechtenstein (1), New Zealand (1), Peru (1)

Our sponsors

Submissions opening: March 31, 2025

Submissions deadline: June 1, 2025

The EUROFIDAI-ESSEC Paris December Finance Meeting will hold its 23rd edition in-person in downtown Paris (Pullman Paris Montparnasse Hotel) on December 18, 2025.

The conference is organized by EUROFIDAI (European Financial Data Institute) and the ESSEC Business School and jointly sponsored by Amundi / PLADIFES / SIX/ CDC Institute for Economic Research / Clipway / CERESSEC.

All researchers are invited to present in English their latest research in all areas of finance. Job market papers are welcomed and integrated in normal sessions. They will be highlighted in the program.

In recent years, the conference has become very selective with one in six submitted papers accepted. The EUROFIDAI-ESSEC Paris December Finance Meeting is ranked 2nd in Europe and 8th in the World among large conferences based on papers published in the Top3 Finance and Top5 Economics journals « Ranking Finance Conferences: An Update by W. Hou, E. Smajlbegovic and D. Urban (Erasmus University Rotterdam) - February, 2025 ».

Prizes will be awarded for the Best Conference Paper and the Best Job Market Paper.

Submission process

Submissions open on March, 31st

Only on-line submissions will be considered for the 2024 Paris December Finance Meeting. Before filling the application form, authors should read the following instructions.

Prepare 2 files in pdf format:

- An anonymous version of the paper (the complete paper without the name(s) of the author(s), the acknowledgements and any indication of author’s affiliation)

- A complete version of the paper including the following information: title, name(s) of the author(s), abstract, keywords, email address for each author, complete address(es)

- The abstract to be filled with the submission form should not exceed 150 words.

Keywords

To complete their submission, authors are asked to classify their paper using 3 keywords (all fields of finance).

Submission fees

The submission fee for each paper is 50€ and non-refundable. Submitting authors will receive a receipt following completion of the submission process.

Authors

Due to the high number of submissions, one author can submit multiple papers (joint or single-authored) but cannot have more than one paper accepted.

Paper diffusion

Accepted papers will be posted on the Financial Economic Network (SSRN) and the website of the conference.

Co-Presidents of the Scientific committee

- Jocelyn Martel - ESSEC Business School

- Elise Gourier - ESSEC Business School

2025 Scientific committee

- Yacine Ait-Sahalia - Princeton University

- Nihat Aktas - WHU Otto Beisheim School of Management

- Patrick Augustin - McGill University

- Laurent Bach - ESSEC Business School

- Antoine Baena - Banque de France

- Romain Boulland - ESSEC Business School

- Marie-Hélène Broihanne - Université de Strasbourg

- Catherine Casamatta - TSE & IAE, Université de Toulouse 1 Capitole,

- Georgy Chabakauri - London School of Economics

- Jean-Edouard Colliard - HEC Paris

- Pierre Collin-Dufresne - EPFL

- Ian Cooper - London Business School

- Ettore Croci - Universita Cattolica del Sacro Cuore

- Serge Darolles - University Paris-Dauphine

- Matt Darst - Board of Governors of the Federal Reserve

- Laurence Daures - ESSEC Business School

- Eric de Bodt - Norwegian School of Economics

- François Degeorge - University of Lugano

- Catherine D'Hondt - UC Louvain

- Alberta Di Giuli - ESCP Europe

- Philippe Dupuy - EM Grenoble

- Matthias Efing - HEC Paris

- Ruediger Fahlenbrach - EPFL & SFI

- Félix Fattinger - WU Vienna University of Economic and Business

- Patrice Fontaine - EUROFIDAI - CNRS

- Andras Fulop - ESSEC Business School

- Jean-François Gajewski - IAE Lyon

- Roland Gillet - University Paris I Panthéon-Sorbonne

- Edith Ginglinger- Université Paris-Dauphine

- Elise Gourier - ESSEC Business School

- Peter Gruber - Università della Svizzera Italiana

- Alex Guembel - Toulouse School of Economics

- Georges Hübner - HEC Liège

- Julien Hugonnier - EPFL

- Heiko Jacobs - University of Duisburg-Essen

- Sonia Jimenez - Grenoble INP

- Alexandros Kostakis - University of Liverpool

- Dmitry Kuvshinov - Universitat Pompeu Fabra

- Jongsub Lee - Seoul National University

- Junye Li - Fudan University

- Abraham Lioui - EDHEC

- Elisa Luciano - Collegio Carlo Alberto

- Victor Lyonnet - Ohio State University

- Yannick Malevergne - Université de Paris 1 Panthéon-Sorbonne

- Roberto Marfé - Collegio Carlo Alberto

- Jocelyn Martel - ESSEC Business School

- Maxime Merli - Université de Strasbourg

- Sophie Moinas - Toulouse School of Economics

- Lorenzo Naranjo - Washington University in Saint-Louis

- Lars Norden - EBAPE/FVG

- Clemens Otto - Singapore Management University

- Loriana Pelizzon - Goethe University

- Fabricio Perez - Wilfrid Laurier University

- Christophe Pérignon - HEC Paris

- Joël Petey - Université de Strasbourg

- Ludovic Phalippou - Oxford University

- Alberto Plazzi - University of Lugano & SFI

- Sébastien Pouget - Toulouse School of Economics

- Vesa Pursiainen - University of St. Gallen

- Sofia Ramos - ESSEC Business Schooll

- Jean-Paul Renne - HEC Lausanne

- Michel Robe - Robins School of Business, University of Richmond

- Tristan Roger - ICN

- Jeroen Rombouts - ESSEC Business School

- Guillaume Roussellet - McGill University

- Julien Sauvagnat - Bocconi University

- Olivier Scaillet - University of Geneva & SFI

- Mark Seasholes - Arizona University

- Paolo Sodini - Stockholm School of Economics

- Christophe Spaenjers - University of Colorado Boulder

- Peter Tankov - ENSAE Paris

- Roméo Tédongap - ESSEC Business School

- Erik Theissen - University of Mannheim

- Boris Vallée - Harvard Business School

- Philip Valta - University of Bern

- Guillaume Vuillemey - HEC Paris

- Rafal Wojakowski - Surrey Business School

- Alminas Zaldokas - NUS

- Olivier-David Zerbib - ENSAE Paris

- Marius Zoican - University of Toronto

SUBMISSIONS ARE CLOSED!

Timeline

- Submissions opening: March 31, 2025

- Submissions deadline: June 1, 2025

- Notice of acceptance: early July, 2025

- Registration deadline for accepted authors: July 20, 2025

- Online Program: October, 2025

- Registration deadline for other participants: December 5, 2025

December 18, 2025 - Parallel sessions

08:00 - 09:00

09:00 - 10:30

Asset Pricing I ( 12/18/2025 at 09:00 to 12/18/2025 at 10:30 )

Presiding : Abraham Lioui (EDHEC)

Room : ROOM 1

Persistent Anomalies and Nonstandard Errors

Authors : Pérignon Christophe (HEC Paris) ; Coqueret Guillaume (EM Lyon)

Presenter : Christophe Pérignon (HEC Paris)

Discussant : Teodor Dyakov (Edhec)

We develop a framework for rigorous inference when assessing asset pricing anomalies and accounting for multiple methodological choices. We demonstrate that running multiple paths on the same dataset results in high correlation across outcomes, biasing inference. Alternatively, path-specific resampling reduces outcome correlations and tightens the confidence interval of the average return. Accounting for across and within-path variability allows us to decompose the variance of the average return into a standard error, a nonstandard error, and a correlation term. Empirically, we identify 29 persistent anomalies with statistically significant average returns and show that, for most anomalies, nonstandard errors dominate standard errors.

Download paperA Battle of Wills: The Joint Impact of Sentiment and Benchmarking on Volatility and Mispricing

Authors : Goncalves-Pinto Luis (University of New South Wales) ; Sotes-Paladino Juan (Universidad de Los Andes) ; Roche Herve (Universidad de Los Andes)

Presenter : Juan Sotes-Paladino (Universidad de Los Andes)

Discussant : Rodolfo Prieto (INSEAD)

Standard models predict a positive relationship between investor sentiment and volatility, yet the empirical evidence suggests otherwise. We reconcile this discrepancy in a model with retail sentiment and institutional benchmarking. The interaction of these features reshapes how fundamental risk translates into return volatility, creating an asymmetric relationship with sentiment. It also explains why institutions can reduce mispricing under heightened sentiment. Using exogenous variation in institutions’ benchmarking intensity, we provide causal evidence on the predicted impact of institutions on volatility for different sentiment levels. We also offer evidence on the predicted effect of sentiment and institutions on mispricing.

Download paperWhat Explains Momentum When It Really Works?

Authors : Barroso Pedro (Universidade Católica Portuguesa) ; Wang Haoxu (Sustainable and Green Finance Institute, National University of Singapore)

Presenter : Pedro Barroso (Universidade Católica Portuguesa)

Discussant : Andrea Tarelli (Catholic University of Milan)

Puzzlingly, the literature has shown that behavioral factors capturing mispricing, the neoclassical-inspired investment q-factors, and momentum in factors can all subsume individual stock momentum. But tests subsuming momentum are unconditional while the bulk of its profits are predictable using its own lagged volatility. We compare asset pricing models conditionally, when the strategy really works, and find the unconditional fit misleading. Models fit well most times but not when profits are produced. Strikingly, momentum’s conditionality cannot be attributable to either q-factors or factor momentum. Yet, both earnings announcement returns and analyst forecast errors show strong conditionality consistent with an underreaction channel.

Download paper09:00 - 10:30

Mortgages ( 12/18/2025 at 09:00 to 12/18/2025 at 10:30 )

Presiding : Joël Petey (Universite de Strasbourg)

Room : ROOM 2

A Public-Private Partnership? Central Bank Funding and Credit Supply

Authors : Elliott David (Bank of England) ; Chavaz Matthieu (Bank for International Settlements) ; Monroe Win (Bank for International Settlements)

Presenter : David Elliott (Bank of England)

Discussant : Tian Tao (University College Dublin)

We exploit the surprise announcement and subsequent amendment of a central bank funding scheme to test how public liquidity provision affects credit market outcomes. Contrary to the notion that public liquidity is primarily a substitute for private liquidity, banks that are more exposed to stress in private wholesale funding markets use less central bank funding. We rationalise this pattern by establishing an “equilibrium channel” of public liquidity. The mere availability of central bank funding reduces the cost of private wholesale funding. This stimulates lending by banks exposed to wholesale funding, regardless of whether they actually use the central bank funding. Using a surprise amendment to the design of the scheme, we show that the “strings attached” to central bank funding help to explain why it is an imperfect substitute for private funding.

Download paperThe Value of Mortgage Choice: Payment Structure and Contract Length

Authors : Boutros Michael (University of Toronto) ; Clara Nuno (Duke University) ; Kartashova Katya

Presenter : Nuno Clara (Duke University)

Discussant : David Elliott (Bank of England)

We study how households choose between three mortgage contracts with different payment structures: fixed-rate fixed-payment, variable-rate variable-payment, and a hybrid variable-rate fixed-payment mortgage where interest rate changes affect principal repayment rather than payment size. This hybrid contract, which is offered in only a few countries around the world, gives households additional flexibility to insure against payment risk while exposing them to the risk of larger future mortgage balances. We model these mortgage types simultaneously and show that welfare is substantially improved when all three contracts are available for households to choose from. Our calibrated model matches mortgage choice patterns in Canada, where all these options are offered with short terms. We demonstrate that restricting contract choice or mandating long terms, as in the U.S. system, can lead to substantial welfare losses by limiting risk management strategies and increasing mortgage pricing ex-ante.

Download paperLoan Officers, Same-Sex Couple Mortgages and Non-discrimination Law (Job Marker Paper)

Authors : Tao Tian (University College Dublin) ; Muckley Cal (University College Dublin)

Presenter : Tian Tao (University College Dublin)

Discussant : Nuno Clara (Duke University)

We examine the effect of non-discrimination law (NDL) on loan officers' decisions for LGBTQ+ couple loan applications in the home mortgage market. We find that NDL widens the denial gap between same- and different-sex couple loan applications. This cannot be explained by a backlash in loan officers' opinions against NDL. It can be attributed to a post-NDL surge in LGBTQ+ loan applications and loan officers' inexperience in evaluating soft information, e.g., the commitment of same-sex couples to service a loan compared to different-sex couples, on their credit worthiness. Pre- and post-NDL denial gaps are accounted for via this heterogeneity in processing soft information. FinTech loan decisions, informed by algorithms, show no effect of NDL. Experienced loan officers attenuate the post-NDL denial gap. Our findings imply a new non-discrimination training mandate for loan officers.

Download paper09:00 - 10:30

Market Microstructure I (PLADIFES) ( 12/18/2025 at 09:00 to 12/19/2025 at 10:30 )

Presiding : Sabrina Buti (Paris IX-Dauphine)

Room : ROOM 3

Hiding in Plain Sight: Preferred Habitat Effects in Short-Term Rates

Authors : Mattille Edouard (University of St. Gallen)

Presenter : Edouard Mattille (University of St. Gallen)

Discussant : Miklos Vari (ESSEC Business School)

This paper uncovers that 30% of overnight interbank lending is driven by banks’ usage of securitized “repo” instruments to make uncovered trades in bond markets. I exploit a regulatory reform that shortened the fixed income settlement cycle to identify a class of agents that systematically uses repo to source cash and securities in time for delivery; these institutions instantly shifted their trading to a correspondingly shorter repo maturity to continue rolling over their strategies. I demonstrate that this dynamic distorts both the term structure of interest rates as well as the transmission of the monetary policy rate. This paper thus identifies a preferred habitat effect at the core of interbank funding markets, a notable finding given the ultra-short-term nature of this segment. Finally, I quantify the resulting spillover to the cost of credit in the real economy.

Download paperInstitutional Ownership Concentration and Informational Efficiency

Authors : Xiong Yan (University of Hong Kong) ; Yang Liyan (University of Toronto) ; Zheng Zexin (Hong Kong University of Science and Technology)

Presenter : Zexin Zheng (Hong Kong University of Science and Technology)

Discussant : Fabrice Riva (Paris Dauphine University - PSL)

We study how the concentration of ownership among institutional investors influences price informativeness in financial markets. We find that an increase in institutional ownership concentration — whether measured by investors’ assets under management or their firm-level holdings — reduces price informativeness and investment-to-price sensitivity. This negative effect is attributed to the learning and trading decisions of active, rather than passive, investors. To establish causality, we utilize a setting involving mergers between active investors, and our results remain consistent across international contexts.

Download paperOptimal Automated Market Maker

Authors : Zhou Zhengge (Warwick Business School)

Presenter : Zhengge Zhou (Warwick Business School)

Discussant : Julian Prat (CNRS, CREST)

Although the Walrasian auctioneer achieves efficient asset allocation, it remains a theoretical abstraction. This paper shows that, within blockchain-based decentralised exchanges, an optimally designed automated market-making (AMM) algorithm can attain Walrasian efficiency in practice. Specifically, given the demand schedules submitted by liquidity providers, the optimal AMM minimises trading costs for liquidity demanders by aggregating these schedules in a liquidity-weighted manner. Furthermore, this optimal AMM is implementable within a decentralised governance framework, in which LPs bargain over trade allocations and are incentivised to report their demand schedules truthfully to the AMM algorithm.

Download paper09:00 - 10:30

Product Market Relationships ( 12/18/2025 at 09:00 to 12/18/2025 at 10:30 )

Presiding : Julien Sauvagnat (Bocconi University)

Room : ROOM 4

It's not easy being green

Authors : Kim Daniel (University of Waterloo) ; Brogaard Jonathan (University of Utah) ; Gerasimova Nataliya (BI Norwegian Business School) ; Rohrer Maximilian (Norwegian School of Economics)

Presenter : Nataliya Gerasimova (BI Norwegian Business School)

Discussant : Victor Saint-Jean (ESSEC Business School)

This paper examines the green cost premium paid by customers and its underlying economic drivers. Using a large panel of nearly identical US federal procurement contracts -- some green, some not -- we estimate a premium of 25-38\%. Accounting for potential biases using a Bartik instrument and a natural experiment reveals an even higher premium, reaching up to 188\%. The green premium varies significantly across agencies and product types, driven in part by environmental characteristics and institutional experience. Much of the added cost reflects upfront investments to meet sustainability standards, along with regulatory complexity and supply chain frictions, rather than differences in contract size, quality, or competition. These findings suggest that a successful green transition depends not only on investors’ willingness to pay, as emphasized in prior literature, but also on customers’ readiness to bear higher costs for sustainable goods.

Download paperThe Carbon Cost of Competitive Pressure

Authors : Xiang Yue (Durham University) ; Pursiainen Vesa (University of St.Gallen and Swiss Finance Institute) ; Sun Hanwen (University of St.Gallen and Swiss Finance Institute)

Presenter : Vesa Pursiainen (University of St.Gallen and Swiss Finance Institute)

Discussant : Thorsten Martin (Frankfurt School of Finance & Management)

Higher exposure to competition -- measured by product fluidity -- is associated with higher carbon emission intensity, via both higher absolute emissions and lower revenues. This result is robust to using instrumental variables to obtain exogenous variation in fluidity and holds when using only reported emission data, excluding estimated emissions. Higher emissions in the short-term are not followed by medium-term improvements, suggesting that competition does not pressure companies to become greener. The relationship between competition and carbon emissions is stronger in areas less concerned about climate change and areas with weaker social norms, as well as for less profitable firms.

Download paperThe Private Value of Open-Source Innovation

Authors : Emery Logan (Erasmus University Rotterdam) ; Lim Chan (University at Buffalo) ; Ye Shiwei (University at Buffalo)

Presenter : Chan Lim (University at Buffalo)

Discussant : Ekaterina Gavrilova (Nova SBE)

We investigate open-source innovation by public firms and the private value it generates for these firms. Unlike patents, which grant inventors exclusive rights to their inventions, open-source innovations can be used by anyone. Nevertheless, using an extensive dataset of public-firm activity on GitHub, we find that firms with open-source projects represent 68% of the U.S. stock market across 86% of industries. We estimate the private value of all projects in our sample to be nearly $25 billion, with the average project generating $842,000. We find that projects with fully permissive licenses are generally less valuable and firms facing higher competition tend to generate less private value from their projects. We also find that the degree to which a project complements commercial products is not a primary driver of private value. Finally, open-source value is associated with a firm’s substantial growth in terms of sales, profits, employment, and patenting, yet it also induces creative destruction. These results contribute to our understanding of the private value generated by innovation in the absence of legal excludability.

Download paper09:00 - 10:30

Capital Structure ( 12/18/2025 at 09:00 to 12/18/2025 at 10:30 )

Presiding : Guillaume Vuillemey (HEC Paris)

Room : ROOM 5

Signals in the Noise: The Asymmetric Validation of Dividends and Share Repurchases

Authors : Schneider Constantin (University of Münster)

Presenter : Constantin Schneider (University of Münster)

Discussant : Romain Boulland (ESSEC Business School)

While corporate payout policy is well-studied in North America, its valuation effects across diverse global markets remain a persistent enigma. This study resolves this puzzle by proposing and testing a Theory of Context-Dependent Signal Dominance and Asymmetric Validation. The theory posits that payout valuation is determined by the dominance of two competing signals, a negative capital allocation signal and a positive shareholder commitment signal, and that the validation mechanisms for dividends and repurchases are fundamentally asymmetric. Testing this theory on a comprehensive global panel from 1992 to 2024, I find a duality in the dividend signal. From an enterprise value perspective, institutional quality acts as an information substitute, leading to a dividend discount in transparent markets. Conversely, from a shareholder perspective, it acts as a commitment validator, unlocking a premium only when investor protection is strong. In contrast, share repurchases are validated intrinsically by their financial scale while the premium for their scale is highest in less transparent markets, consistent with an information substitution effect, though their valuation is fundamentally anchored in the trust established by a country’s deep-rooted legal origin. Channel tests confirm this asymmetry. An institutionally-validated dividend credibly predicts future earnings, while a largescale repurchase primarily mitigates present agency costs without signaling future performance. These findings reveal that dividend signals are context-dependent, their ability to cut through noise is dependent on the interplay of institutional forces, while repurchase signals rely on the ”brute force” of their own scale, with their reception shaped by the deep grammar of legal traditions.

Download paperReal Effects of Bernanke–Kuttner: The Risk Channel of Monetary Policy Announcement on Corporate Investment (Job Market Paper)

Authors : Ren Zhou (Vienna Graduate School of Finance)

Presenter : Zhou Ren (Vienna Graduate School of Finance)

Discussant : Sarah Mouabbi (Banque de France)

Monetary policy announcements convey information that affects risk premia and risk perceptions in financial markets, but little is known about the real effects of this “risk news.” I provide causal evidence that announcement news that raises financial market risk perceptions reduces subsequent corporate investment in tangible capital, with effects most pronounced for firms with higher debt burdens. Aggregate news shocks are identified using price changes across asset classes within the FOMC announcement window and decomposed to obtain a risk component. The results hold after controlling for interest rate surprises, thereby isolating the effect of announcement risk news independent of policy rate news. Consistent with a flight to quality mechanism in credit markets, risk-raising announcement news increases external finance costs for firms with a high debt burden. These firms curtail net borrowing, build precautionary cash buffers, and face higher total interest expense; investment cuts are concentrated when these highly indebted firms also have short debt maturities, indicating heightened rollover risk. At the aggregate level, the investment response to announcement risk news is insignificant unconditionally, but it is state dependent: it strengthens to economically meaningful magnitudes when the share of firms facing high rollover risk is larger.

Download paperShale Debt Structure and Pollution Control

Authors : Jiang Binghan (Paris Dauphine University) ; Selezneva Veronika (Paris Dauphine University) ; Kosar Mariia (CERGE-EI)

Presenter : Binghan Jiang (Paris Dauphine University)

Discussant : Jean-Stéphane Mésonnier (Banque de France / Sciences-Po)

This paper analyzes how firms in the shale oil industry adjusted their production in response to green policy shocks, particularly after the Paris Agreement. We find that firms with high levels of short-term debt faced significant refinancing challenges, reflected in reduced bond issuance, weaker new bank lending, declining credit ratings, and higher costs of debt. Using a novel well-level index of toxic chemical usage combined with firm-level financial data, we employ a difference-in-differences–like approach to show that highly indebted firms significantly reduced their use of toxic chemicals by 52.5% following the policy shock. Empirically, we find that after the Paris Agreement, tighter financing conditions and heightened reputational concerns led firms to curb toxic-intensive operations. These findings highlight how climate commitments can influence environmental outcomes through financially induced pressure.

Download paper09:00 - 10:30

Hedge Funds / Mutual Funds (AMUNDI) ( 12/18/2025 at 09:00 to 12/18/2025 at 10:30 )

Presiding : Shema Mitali (Skema)

Room : ROOM 6

Time Series Reversal: An End-of-the-Month Perspective

Authors : Giuliano Graziani (Bocconi University)

Presenter : Graziani Giuliano (Bocconi University)

Discussant : Sofonias Korsaye (John Hopkins University)

This paper documents a new pattern in U.S. aggregate markets: S&P 500 month-end returns negatively predict one-month-ahead returns. Novel in the reversal literature, this pattern is at the aggregate level, persists throughout the following month, clusters on the most liquid U.S. indices, is cyclical, and delivers sizable gains without the need for short selling. Institutional trading data link the novel pattern to pension funds month-end liquidity trading to meet benefit payments. Results are robust across specifications, in- and out-of-sample tests, and extensive controls, pointing to a recurring impact of pension funds’ trading on aggregate prices and efficiency.

Download paperValue Creation in the Hedge Fund Industry

Authors : Ardia David (HEC Montréal) ; Barras Laurent (University of Luxembourg)

Presenter : Laurent Barras (University of Luxembourg)

Discussant : Mirco Rubin (EDHEC)

We develop an approach to jointly study four dimensions of hedge fund value creation--its drivers, split, dynamics, and optimality. This approach captures the large fund heterogeneity and controls for hedge fund complexities. We find that most funds add value via their unique skills but face strong scalability constraints--a feature that prevents them from systematically dominating mutual funds. Hedge fund investors slowly improve their fund capital allocation over time, which suggests an impactful but noisy learning process. Despite these efforts, they extract a modest fraction of the total value. These findings fit reasonably well with an equilibrium model featuring funds with heterogeneous skill and scalability and investors with limited bargaining power.

Download paperWill AI Replace or Enhance Human Intelligence in Asset Management?

Authors : Kim Hugh (Wilfrid Laurier University) ; Nanda Vikram (The University of Texas at Dallas)

Presenter : Vikram Nanda (The University of Texas at Dallas)

Discussant : Maxime Bonelli (London Business School)

Using data from LinkedIn profiles, we measure the adoption of AI technologies by mutual fund managers. Compared to low-AI funds, high-AI funds generate superior returns and incur lower expenses. The stock-picking abilities of high-AI funds improve with the availability of big data, such as satellite imagery of parking lots. Consistent with AI complementing investment skills, outperformance is particularly strong among discretionary funds, which rely on human judgment, as opposed to quantitative funds. The greater the AI adoption, the more pronounced the time-varying skill of fund managers across different market conditions. The local availability of AI skills is a key determinant of cross-sectional variation in mutual fund AI investment. Our findings are robust to using geographic variation in AI supply as an instrument for AI utilization by mutual funds.

Download paper10:30 - 11:00

11:00 - 12:30

Asset Pricing II ( 12/18/2025 at 11:00 to 12/18/2025 at 12:30 )

Presiding : Mariano Massimiliano Croce (Bocconi University)

Room : ROOM 1

Green Intermediary Asset Pricing

Authors : Sauzet Maxime (Boston University)

Presenter : Maxime Sauzet (Boston University)

Discussant : Federico Belo (INSEAD)

Can environmentally-minded investors impact the cost of capital of green firms even when they invest through financial intermediaries? To answer this and related questions, I build an equilibrium intermediary asset pricing model with three investors, two risky assets, and a riskless bond. Specifically, two heterogeneous retail investors invest via a financial intermediary who decides on the portfolio allocation that she offers between a green and a brown equity. Both retail investors and the financial intermediary can tilt towards the green asset, beyond pure financial considerations. Perhaps surprisingly, the green retail investor can have significant impact on the pricing of green assets, even when she invests via an intermediary who does not tilt: a sizable green premium --that is, a lower cost of capital-- can emerge on the equity of the green firm. This good news comes with important qualifications, however: the green retail investor has to take large leveraged positions in the portfolio offered by the intermediary, her strategy must be inherently state-dependent, and economic conditions or the specification of preferences can overturn or limit the result. When the financial intermediary decides (or is made) to tilt instead, the impact on the green premium is substantially larger, although it is largest when preference are aligned with retail investors. I also study what happens when the green retail investor does not know the weights in the portfolio offered by the intermediary, the potential impact of greenwashing, and the effect of portfolio constraints. Taken together, these findings highlight the central role that financial intermediaries can play in channeling financing (or not) towards the green transition.

Download paperShifts in Trading: From Stocks to ETFs

Authors : Egle Karmaziene (Vrije Universiteit Amsterdam) ; Christopher Rigsby (Vrije Universiteit Amsterdam)

Presenter : Egle Karmaziene (Vrije Universiteit Amsterdam)

Discussant : Alireza Aghaee Shahrbabaki (Imperial College Business School)

We examine how market participants respond to exogenous declines in stock liquidity by reallocating trading activity toward exchange-traded funds (ETFs). Using the SEC’s Tick Size Pilot Program as a quasi-natural experiment, we show that ETFs with greater exposure to affected stocks experience a 55% increase in trading volume. Despite holding less-liquid underlying assets, these ETFs maintain stable trading costs and expand supply: shares outstanding increase by 22.5% and market capitalization by 25.9%. Treated ETFs are also more likely to trade at a premium, indicating that secondary-market demand temporarily outpaced creation. However, the absence of spread widening or volatility changes suggests the arbitrage mechanism remained intact, albeit gradual. Our findings highlight the role of ETFs as friction-resistant liquidity substitutes during market stress. They absorb displaced trading activity and preserve access to equity exposure even when direct stock trading becomes costly, underscoring their importance in the transmission of liquidity across modern financial markets.

Download paperLabor shortage, Hiring and Stock Returns (Job Market Paper)

Authors : Liu Xinyu (INSEAD)

Presenter : Xinyu Liu (INSEAD)

Discussant : Marco Grotteria (London Business School)

This paper demonstrates how hiring constraints affect firm valuation through the discount rate channel in both cross-sectional and time-series analyses. I construct portfolios based on firms' labor shortage discussions in SEC filings and find that hiring-constrained firms exhibit low average stock returns. This return predictability is most pronounced among firms with high hiring activity. Similarly, among hiring-- constrained firms, those with aggressive hiring demonstrate the lowest average stock returns. This pattern reflects a fundamental rule in corporate investment decisions: when firms continue to hire aggressively despite labor constraints, their cost of capital must be sufficiently low to justify these hiring, if profitability does not explain the behavior. I formalize this mechanism through a Q-theory-based model that incorporates varying adjustment costs of hiring, demonstrating how hiring frictions generate predictable patterns in stock returns and providing new insights into the relationship between labor market conditions and asset pricing.

Download paper11:00 - 12:30

Banking / Financial Intermediation I ( 12/18/2025 at 11:00 to 12/18/2025 at 12:30 )

Presiding : Christophe Pérignon (HEC Paris)

Room : ROOM 2

Competition, Complexity, and Security Design: Evidence from Retail Investment Products

Authors : Marc Chesney (University of Zurich) ; Felix Fattinger (Vienna University of Economics and Business) ; Jonathan Krakow (University of Zurich) ; Simon Straumann (WHU - Otto Beisheim School of Management)

Presenter : Felix Fattinger (Vienna University of Economics and Business)

Discussant : Sylvain Benoit (Paris Dauphine University)

We investigate the role of strategic security design by analyzing the market for retail investment products. Focusing on a dominant yet understudied design feature, we provide evidence that issuers strategically increase product complexity to mitigate price competition. Because complex products yield lower returns, carry higher risk, and are first-order dominated by simpler products, rising market complexity increases uncompensated risk-taking, particularly among less sophisticated investors. Our findings suggest that complexity is not merely a by-product of catering to yield-seeking investors but rather a deliberate design choice to preserve issuer rents.

Download paperPayout Restrictions and Bank Risk-Shifting

Authors : Fringuellotti Fulvia (Federal Reserve Bank of New York) ; Kroen Thomas (International Monetary Fund)

Presenter : Fulvia Fringuellotti (Federal Reserve Bank of New York)

Discussant : Yann Braouezec (IESEG)

This paper studies the effects of regulatory payout restrictions on bank risk-shifting. Using policies imposed during the Covid-crisis on US banks as a natural experiment and a high frequency differences-in-differences approach, we show that, when payouts are restricted, banks’ equity prices fall while their debt values appreciate. Moreover, banks that are ex-ante more exposed to the payout restrictions decrease risk-taking in lending relative to less exposed banks. Consistent with a risk-shifting channel, these effects revert once restrictions are lifted. These results indicate that payout and risk-taking choices are complementary and that regulatory payout restrictions endogenously affect bank risk-shifting.

Download paperCournot Competition in the Loan Market: Microfoundations and Limitations

Authors : Lattanzio Chiara (University College London)

Presenter : Chiara Lattanzio (University College London)

Discussant : Raphael Levy (HEC Paris)

When firms choose their capacity and then compete `a la Bertrand, the market equilibrium can correspond to the Cournot outcome (Kreps & Scheinkman, 1983). In the banking sector, a bank’s lending capacity is constrained by its capital structure due to regulatory capital requirements. This paper establishes the conditions under which the Bertrand-Cournot equivalence extends to banks. I treat capital as an imperfect capacity commitment, allowing banks to distribute dividends and raise additional capital at a short-term premium during the competition stage. I show under which conditions the Cournot outcome is the unique equilibrium of the game. Such micro-foundations for Cournot competition in the loan market open new perspectives to the modeling of an elaborate, yet tractable, banking sector in macroeconomic models.

Download paper11:00 - 12:30

Climate / Corporate Governance (CERESSEC) ( 12/18/2025 at 11:00 to 12/18/2025 at 12:30 )

Presiding : Catherine Casamatta (TSE & Universite Toulouse Capitole (TSM) )

Room : ROOM 3

Green Moral Hazard: Estimating the Financial and Non-financial Impacts of CEO Incentives

Authors : Jaehoon Jung (NYU Stern School of Business)

Presenter : Jaehoon Jung (NYU Stern School of Business)

Discussant : Sophie Moinas (Toulouse School of Economics)

I develop a novel structural model for analyzing the financial and non-financial implications of CEO compensation contracts that include incentives tied to non-financial performance. By applying this model to green incentives, I find that they motivate CEOs to reduce carbon emission intensity by 1.8% per year but at a financial cost of 1.3% of firm value annually. As green performance is an imperfect signal of CEOs’ actions toward green outcomes, a “green moral hazard” arises: the principal should offer CEOs a premium for the risk added by green incentives. I estimate that this green moral hazard is substantial, accounting for $1.72 million of the total moral hazard cost of $2.05 million. These results suggest that green incentives pose an important economic trade-off: while green incentives can lead to meaningful environmental improvements, they impose substantial costs on the firm.

Download paperShort-Termis Carbon Emissions (Job Market Paper)

Authors : Maeckle Kai (Mannheim University)

Presenter : Kai Maeckle (Mannheim University)

Discussant : Stefano Lovo (HEC Paris)

Carbon abatement investments are long-term in nature. Therefore, short-term profit pressure may distort these investments. Consistent with this idea, firms that just meet analysts’ short-term profit targets have about five percentage points higher growth in carbon emissions than firms that just miss. I estimate a quantitative model in which managers choose carbon emissions subject to optimal short-term incentives. Removing short-term incentives reduces firms’ profits by 0.43% and carbon emissions by 2.19%. In aggregate, short-termist carbon emissions are as large as total U.S. aviation emissions in 2022. My estimates suggest that short-termism is welfare-reducing via the carbon emissions channel.

Download paperThe Demand, Supply, and Market Responses of Corporate ESG Actions: Evidence from a Nationwide Experiment in China

Authors : Xiahou Qinrui (University of Hong Kong) ; He Guojun (University of Hong Kong)

Presenter : Qinrui Xiahou (University of Hong Kong)

Discussant : Vanessa Valero (Institut Mines-Telecom Business School)

We conducted a nationwide field experiment with 4,800+ Chineselisted companies, randomly raising ESG concerns to their management teams via high-visibility and high-stakes online platforms. Tracking the full impact-generating process, we find that companies respond to our concerns by providing high-quality answers, publishing ESG reports, and making commitments to investors. Over time, Environmental (E) inquiries boost stock valuations, while Governance (G) concerns prompt skepticism. Productive and opaque firms are more likely to respond, consistent with a signaling model where costly ESG actions signal firm quality under information asymmetry. Overall, ESG actions are likely driven by profit-oriented signaling rather than values-based motives.

Download paper11:00 - 12:30

Market Efficiency ( 12/18/2025 at 11:00 to 12/18/2025 at 12:30 )

Presiding : Jérôme Dugast (ESSEC)

Room : ROOM 4

Early Price Discovery in IPOs

Authors : Pezier Emmanuel (Said Business School, University of Oxford) ; Divakaruni Anantha (University of Bergen) ; Jones Howard (University of Bergen)

Presenter : Anantha Divakaruni (University of Bergen)

Discussant : Carole Gresse (Paris Dauphine University)

We study how information revealed by investors prior to bookbuilding influences IPO pricing and allocations. Using a novel dataset of investor-underwriter meetings and exploiting new airline route launches as an exogenous shock that reduces travel times and facilitates these interactions, we show that precise and optimistic investor feedback narrows the indicative price range and raises offer prices. Investors who engage in pre-bookbuilding discussions are subsequently more likely to submit bids and receive larger, more profitable allocations, providing strong causal evidence for information revelation theories. Our findings shed light on the historically opaque role of early investor engagement in shaping IPO outcomes, with key implications for capital markets design and regulation.

Download paperSocial Media Noise and Stock Manipulation

Authors : Tran Vu (University of Reading) ; Cumming Douglas (Florida Atlantic University)

Presenter : Vu Tran (University of Reading)

Discussant : Daniel Schmidt (HEC Paris)

This paper models stock manipulations where investors interact via social network communications. We propose a novel noise index in social media platforms. The model predicts that high volumes of social media noise significantly increase probability of success, profitability for manipulators as well as heighten trading volume of manipulated stocks. In addition, manipulation profitability increases with respect to the number of followers in social media posts mentioned the manipulated stock. Empirical investigations, based on over 3,800 U.S. small-cap stocks during January 2010 to 2018 December, confirm the theoretical predictions and hypotheses. Our paper demonstrates an urgent need for monitoring social media platforms in safeguarding financial market efficiency.

Download paperFlow-Driven Corporate Finance: A Supply-Demand Approach

Authors : Zhang Hulai (Tilburg University and ESCP)

Presenter : Hulai Zhang (Tilburg University and ESCP)

Discussant : Paul Huebner (Stockholm School of Enonomics)

This paper develops a supply-demand framework to quantify and decompose the effects of investor demand on corporate financing and investment. The framework extends demand-based asset pricing models by incoporating endogenous corporate decisions. Using Gabaix and Koijen (2024)'s granular instrumental variable approach, I estimate the model parameters and find that a $1 investor flow results in $0.012 in share issuance within the first quarter and a cumulative $0.24 over two years. Similarly, a 1% investor flow increases firm investment by 0.19% over two years. The results show significant asymmetry: firms respond more strongly to inflows than outflows. Counterfactual analysis reveals that investor preferences substantially dampen firms' investment responses to flows. The framework also provides a novel tool to evaluate the role of firms in stabilizing the stock market.

Download paper11:00 - 12:30

FinTech and Cryptocurrencies (CERESSEC) ( 12/18/2025 at 11:00 to 12/18/2025 at 12:30 )

Presiding : Luciano Somoza (ESSEC)

Room : ROOM 5

Platform Credit, Advertising, and Customer Capital

Authors : Efing Matthias (HEC Paris) ; Huang Yi (BIS) ; Han Ruobing (BIS) ; Sun Qi (Shanghai Univerisity of Finance and Economics) ; Xu Daniel Yi (Duke University, NBER, and CEPR)

Presenter : Matthias Efing (HEC Paris)

Discussant : Marco Giometti (Universidad Carlos III)

Advertising plays a crucial role in online marketplaces, where thousands of merchants offer similar products and compete for visibility and consumer attention. This study demonstrates theoretically and empirically that merchants underinvest in building customer capital due to financial constraints. By leveraging quasi-random variation in merchants’ access to credit from a major platform lender, we establish that alleviating financial constraints leads to increases in advertising expenditures, enhanced shop visibility, and accelerated sales growth. The effects are especially pronounced among high-quality merchants with top ratings, suggesting that financial frictions may lead to misallocation of customer capital.

Download paperMacro-Financial Impact of Stablecoin's Demand for Treasuries

Authors : Kim Sang Rae (Kyung Hee University)

Presenter : Sang Rae Kim (Kyung Hee University)

Discussant : Stefano Pietrosanti (Bank of Italy)

This paper studies how the expansion of reserve-backed stablecoins affects Treasury markets and credit intermediation. Using high-frequency data from the Ethereum blockchain matched to intraday Treasury-linked asset prices, I show that large Tether issuance events are followed by statistically significant increases in Treasury prices. To interpret these effects, I develop a quantitative macro-finance model with capitalconstrained banks and stablecoin issuers who hold Treasuries as reserves. The model replicates the empirical findings and reveals nonlinear amplification as the sector grows. I use the framework to evaluate policy scenarios and highlight how crypto sector expansion can reshape Treasury demand and financial stability.

Download paperThe Green Value of BigTech Credit

Authors : Su Dan (Cheung Kong Graduate School of Business), Peng Wang (Sun Yat-Sen University), Xinyi Wang (Peking University), Xiaoyun Yu (Shanghai Jiao Tong University)

Presenter : Dan Su (Cheung Kong Graduate School of Business)

Discussant : Charlotte Handler (Southern Methodist University)

We study an incentive-compatible mechanism—embedding financial incentives into non-financial actions—that fosters individual environmental engagement and facilitates the private sector’s internalization of climate externalities. Using a novel dataset of 100,000 randomly selected users from Ant Forest, a widely used personal carbon tracking program within Alipay—China’s leading BigTech platform, we demonstrate that tying eco-friendly behaviors to credit limit adjustments encourages users to engage in green actions. The platform benefits from reduced default risk even amid credit expansion, likely driven by a signaling mechanism in which costly green actions reveal environmental type. Climate-responsible individuals often exhibit conscientious and disciplined behavior across various domains, allowing lenders to infer creditworthiness from green actions. Our structural model estimates an annual green value of $413.20 million generated by linking credit access to green actions. This incentive-based approach yields larger welfare gains than traditional policy instruments such as mandates or subsidies, particularly when public green awareness is low. Our findings identify the screening role of green behaviors in household lending to align environmental values with financial value and highlight alternative data as a viable source for credit allocation.

Download paper11:00 - 12:30

Household Finance I ( 12/18/2025 at 11:00 to 12/18/2025 at 12:30 )

Presiding : Laurent Bach (ESSEC Business School)

Room : ROOM 6

The Response of Debtors to Rate Changes

Authors : Schnorpfeil Philip (Goethe University Frankfurt) ; Fuster Andreas (EPFL) ; Gianinazzi Virginia (EPFL) ; Hackethal Andreas (Goethe University Frankfurt) ; Weber Michael (University of Chicago)

Presenter : Philip Schnorpfeil (Goethe University Frankfurt)

Discussant : Mattia Girotti (Université Paris Dauphine - PSL)

How borrowers respond to future changes in the interest rate on their debt matters for the transmission of monetary policy and for financial stability. Combining data from a large bank, a letter RCT, and an online survey, we study this question in the context of the German mortgage market, where since 2022 borrowers have faced high interest rates when their rate fixation period ends. We find that various borrower actions substantially reduce the impact of higher rates on monthly payments. Survey responses indicate high awareness of the evolution of interest rates and corroborate a strong propensity to prepare for the rate reset, which we show experimentally is sensitive to the size of the rate increase and to the distance from reset. The letter intervention does not affect rate beliefs, consistent with high ex-ante informedness and selection into reading, but increases awareness of available options and refinancing propensities among borrowers who had not taken action until close to the reset date.

Download paperGreen Neighbors, Greener Neighborhoods: Peer Effects in Green Home Investments (Job Market Paper)

Authors : Huang Christine Zhuowei (The University of Texas at Dallas)

Presenter : Christine Zhuowei Huang (The University of Texas at Dallas)

Discussant : Etienne Fize (Institut des Politiques Publiques)

Utilizing a nearest-neighbor research design, I find that households exposed to green neighbors within 0.1 miles are 1.6 times more likely to make their homes green within a year than unexposed households. The exposure also increases the likelihood of multi-property owners certifying their faraway secondary properties green, emphasizing that information from neighbors, not neighborhood characteristics alone, drives the effect. While financial benefits including green home prices, electricity savings, and regulatory incentives strengthen peer effects, pro-environmental preferences do not. An information-cost-based discrete choice model explains the findings and suggests that incorporating peer effect metrics in subsidies may accelerate green home investments.

Download paperConstrained Borrowing and Living Standard: Optimal Consumption/Savings and Investment Policies

Authors : Park Seyoung (University of Nottingham) ; Kim Chanwool (Kenneth C. Griffin Department of Economics, University of Chicago) ; Shin Yong Hyun (Kenneth C. Griffin Department of Economics, University of Chicago)

Presenter : Seyoung Park (University of Nottingham)

Discussant : Sylvain Catherine (Wharton University)

We study the optimal dynamic consumption and portfolio decisions of utility-maximizing agents who wish to maintain a living standard. Our findings reveal that the requirement to uphold a minimum living standard allows borrowing-constrained agents to endogenously determine a wealth threshold, which we refer to as subsistence wealth. Below this threshold, agents optimally choose to consume nothing. However, once their wealth surpasses the subsistence level, they significantly increase their consumption. This behavior aligns more closely with empirical estimates of marginal propensities to consume. Moreover, the presence of subsistence wealth lowers agents’ effective risk aversion, leading them to favor riskier portfolios in the stock market. Finally, we endogenously determine the government’s minimum willingness to pay to support the minimum living standard, which varies with economic conditions.

Download paper12:30 - 14:00

14:00 - 16:00

Asset Pricing III ( 12/18/2025 at 14:00 to 12/18/2025 at 16:00 )

Presiding : Paul Karehnke (ESCP)

Room : ROOM 1

How do Households Suppress the Price of Tail Risk?

Authors : Celerier Claire (University of Toronto- Rotman School of Management) ; Vallee Boris (Harvard Business School) ; Calvet Laurent (Harvard Business School)

Presenter : Claire Celerier (University of Toronto- Rotman School of Management)

Discussant : Julien Penasse (University of Luxembourg)

We examine how households dampen volatility prices through their demand for Short Put Products (SPPs), a globally popular structured product that offers high headline rates in exchange for selling a put option. Using a comprehensive dataset covering all index-linked SPP issuances worldwide since market inception and a structural model, we show that SPP issuance volumes rise when the volatility of the underlying asset is high, as higher volatility allows to offer higher headline rates. In turn, increased SPP issuance drives down the prices of deeply out-of-the-money put options, suppressing the corresponding volatility risk premium.

Download paperThe Risk-Return Puzzle: Backward- versus Forward-Looking Expected Returns

Authors : Delikouras Stefanos (University of Miami) ; Linn Matthew

Presenter : Stefanos Delikouras (University of Miami)

Discussant : Mathis Mörke (ESCP Business School)

The positive relation between risk and expected return is central to financial theory. Empirically, the literature has shown this relationship to be very weak. Using option-based risk-neutral densities and estimated stochastic discount factors, we find that the linear and positive risk-return relation holds in expectation. This result is robust to the choice of discount factor (e.g., non-monotonic, VIX-dependent) used to estimate physical densities. Next, we examine the reason for the negative risk-return relationship in the data. We conclude that the risk-return trade-off holds true in expectation but breaks down empirically due to realized returns being poor proxies of expected returns.

Download paperThe Impact of Active Managers on the Pricing of Underlying Assets in ETFs

Authors : Zhao Ziwei (University of Lausanne and Swiss Finance Institute) ; Trzcinka Charles (Indiana University)

Presenter : Ziwei Zhao (University of Lausanne and Swiss Finance Institute)

Discussant : Laurent Deville (EDHEC Business School)

We investigate the impact of active managers on the information efficiency of the underlying assets in passive ETF portfolios. Specifically, we explore how the increasing popularity of ETFs prompts active mutual fund managers to execute informed trades that generate alpha. Using trade-level data, we test whether trades by skilled active managers more accurately predict future abnormal stock returns as ETF ownership in these stocks rises. By leveraging the annual reclassification of stocks from the Russell 1000 to the Russell 2000 as an exogenous variation, we find that high-alpha mutual funds can mitigate the pricing inefficiency typically associated with ETFs.

Download paperPresidential Cycles in PEAD

Authors : Wang Liyao (Hong Kong Baptist University) ; Da Zhi (University of Notre Dame) ; Zeng Ming (University of Gothenburg)

Presenter : Ming Zeng (University of Gothenburg)

Discussant : Pedro Barroso (Universidad Catolica Portuguesa)

Post-earnings announcement drift (PEAD) displays presidential cycles: it earns 4.1% per year during Democratic presidencies but its profitability increases significantly to 14.9% during Republican presidencies. Survey-based evidence also indicates substantial underreaction to earnings news when the US president is Republican. The tax component of firm earnings exhibits significantly higher volatility during Republican periods, likely reflecting higher tax policy uncertainty. Consistently, we find that the PEAD is much stronger for firms with larger exposure to tax policy changes during Republican presidencies. This explanation accounts for the observed presidential cycles in PEAD, whereas existing explanations for PEAD cannot. The cycles are more pronounced among non-microcap firms.

Download paper14:00 - 16:00

Banking / Financial Intermediation II ( 12/18/2025 at 14:00 to 12/18/2025 at 16:00 )

Presiding : Matthias Efing (HEC Paris)

Room : ROOM 2

Underwater: Strategic Trading and Risk Management in Bank Securities Portfolios

Authors : Vickery James (Federal Reserve Bank of Philadelphia) ; Fuster Andreas ; Paligovora Teodora

Presenter : James Vickery (Federal Reserve Bank of Philadelphia)

Discussant : Quirin Fleckenstein (HEC Paris)

We use bond-level data to study how US banks manage risk in their securities portfolios, focusing on the period of rapidly-rising interest rates in 2022-23, and examine the role of financial and regulatory frictions in shaping bank behavior. Interest rate risk in bank portfolios increased markedly as rates rose, with significant cross-bank heterogeneity depending on ex ante holdings of bonds with embedded options. In response, exposed banks shortened the duration of bond purchases but did not actively sell risky securities or expand “qualified” hedging activity; securities also played a limited role in banks’ responses to deposit outflows. We identify two frictions that can help explain this inertia. First, we find that banks are highly averse to selling underwater bonds at a discount to book value—e.g., banks were 8-9 times more likely to trade bonds with unrealized gains than unrealized losses in 2022-23. This “strategic” trading is more pronounced for banks that do not recognize unrealized losses in regulatory capital and banks facing stock market pressure. Second, frictions in establishing qualified accounting hedges limited hedging activity depending on bond type and accounting classification. Banks did, however, reduce the interest-rate sensitivity of regulatory capital by classifying the riskiest bonds as held-to-maturity.

Download paperBad Bank, Bad Luck? Evidence from 1 Million Firm-Bank Relationships

Authors : Schindler Yannick (London School of Economics) ; Lambert Peter (London School of Economics)

Presenter : Yannick Schindler (London School of Economics)

Discussant : François Derrien (HEC Paris)

This paper examines how bank failures impact firm performance using 36 million loan records from 1.8 million US firms, primarily SMEs. Using 179 bank failures (1990-2023) and difference-in-differences estimation, we find severe, persistent effects despite regulatory safeguards designed to minimize disruption through forced acquisitions. Firms with failed bank relationships are 44.3% more likely to fail within five years, while survivors show 25% lower employment growth versus those with healthy banks. Effects persist over 10 years across crisis and non-crisis periods, hitting smallest firms hardest. Two natural experiments support our findings. Our results suggest bank failures substantially impact the real economy, potentially requiring reassessment of bank failure regulation.

Download paperChina Walls

Authors : Lee Tomy (Central European University) ; Nathan Daniel (Bank of Israel; Hong Kong Polytechnic University) ; Wang Chaojun (The Wharton School, University of Pennsylvania)

Presenter : Tomy Lee (Central European University)

Discussant : Jamie Coen (Imperial College Business School)

We evaluate the enforcement of information barriers—China Walls—within conglomerates. We test for information sharing between walled-off dealers and their affiliate funds using 23 million trades between 2019-2024 in the Israeli Shekel market, where the US SEC enforces the China Walls. Our difference-in-differences design compares the trade volumes and profits of funds that are affiliated with, clients of, or entirely unrelated to a dealer around the days when the dealer is especially likely to hold valuable information. The dealers never trade nor share information with their affiliate funds, despite that they consistently share information with their clients and that the funds within the same conglomerate intensely share information among themselves. From a back-ofthe-envelope calculation, extending the China Walls around the funds would eliminate $23.7 billion in trades, comprising 58% of their trades on the event dates. Our findings persist during crisis and noncrisis periods, and across granular cells of fund and asset characteristics. We reveal remarkable regulatory capacity to control information flows within conglomerates.

Download paperBank Specialization and Credit Relationships in Small-Business Lending (Job Market Paper)

Authors : Cabossioras Yannis (Federal Reserve Board of Governors) ; Tielens Joris (National Bank of Belgium)

Presenter : Yannis Cabossioras (Federal Reserve Board of Governors)

Discussant : Klaas Mulier (KU Leuven)

We study the dynamics of credit relationships between small businesses and specialized banks and analyze the real effects of specialization on this important yet understudied segment of the credit market. Using micro-level data on the universe of corporate credit in Belgium, we show that banks leverage their industry specialization to build and retain relationships with small businesses. In the relationship-building phase, banks charge lower rates in their industries of specialization. In the relationship-retaining phase, lenders subsequently raise rates faster in specialized industries, until they charge similar rates regardless of their level of specialization. Small businesses benefit from bank specialization in the long run through better real outcomes.

Download paper14:00 - 16:00

Climate Finance (PLADIFES) ( 12/18/2025 at 14:00 to 12/18/2025 at 16:00 )

Presiding : Olivier David Zerbib (CREST & ENSAE)

Room : ROOM 3

Green Coins

Authors : Mariano Massimiliano Croce (Bocconi University) ; N Guinez ; Inzunza-Mendez A ; Nguyen T ; Tebaldi C

Presenter : Mariano Massimiliano Croce (Bocconi University)

Discussant : Maxime Sauzet (Boston University)

We propose a novel macrofinance model for the EU area comprising both climate damages and an Emission Trading System that interacts with credit markets with a bias for ‘net-zero’ brown firms and opaque voluntary carbon credit markets. Our model suggests that the implied allocation is far from the first-best. Relevant welfare gains can be obtained in a setting in which a Green Coin Central Bank (GCCB) runs a transparent blockchain in which coins are mined after a decentralized verification of private offsets, and the GCCB manages green coin prices through open market operations.

Download paperDo carbon markets undermine private climate initiatives?

Authors : Klausmann Johannes (UVA Darden School of Business) ; Akey Pat (INSEAD/University of Toronto) ; Appel Ian (INSEAD/University of Toronto) ; Bellon Aymeric (UNC Chapel Hill)

Presenter : Johannes Klausmann (UVA Darden School of Business)

Discussant : Marco Ceccarelli (VU Amsterdam)

We study commitments to reduce emissions by firms subject to the European Union Emission Trading System (EU ETS), the world's largest cap-and-trade program. Commitments are associated with a drop in the number of carbon allowances surrendered, consistent with firms taking actions to reduce their emissions. However, firms subsequently increase their sales of allowances on the secondary market, transferring the right to pollute to others and potentially leaving aggregate emissions unchanged. They do not reduce emissions outside the EU or invest in green technologies. Despite this, firms benefit from commitments via higher ESG scores. Our findings underscore the importance of considering the interaction between carbon markets and private climate initiatives.

Download paperPhysical Climate Risk Factors and an Application to Measuring Insurers’ Climate Risk Exposure

Authors : Jung Hyeyoon (Federal Reserve Bank of New York) ; Engle Robert (New York University) ; Shan Ge (New York University) ; Xuran Zeng (New York University)

Presenter : Hyeyoon Jung (Federal Reserve Bank of New York)

Discussant : Olivier Lopez (CREST, ENSAE, Institut Polytechnique de Paris)

We construct a novel physical risk factor using a portfolio of REITs, long on those with properties highly exposed to climate risk and short on those with less exposure. Combined with a transition risk factor, we assess U.S. insurers’ climate risk through operations and $13 trillion in asset holdings. We measure insurers’ climate risk ex- posure by estimating their stock return sensitivity (climate beta) to the physical and transition risk factors. We find that insurers operating in riskier regions tend to have higher physical climate betas, while those holding more brown assets are associated with higher transition climate betas. Using these betas, we calculate capital short- falls under climate stress scenarios, offering insights into insurers’ resilience to climate risks.

Download paperDecipher Market Responses to Climate TRACE Emission Data Release

Authors : Kadach Igor (IESE) ; Koo Minjae (Korea University) ; Martin Xiumin (Korea University) ; Zhao Meiling (Chinese University of Hong Kong)

Presenter : Igor Kadach (IESE)

Discussant : Jaehoon Jung (NYU Stern)

We study market reaction to the release of facility-level carbon emission information worldwide by the independent not-for-profit organization Climate TRACE. We find a significant negative market reaction of -0.9% ‒ -2.8% to the data release, which intensifies with the degree of underreporting of carbon emissions. The degree of underreporting is positively associated with the inclusion of a carbon metric in executive compensation and institutional ownership, and negatively associated with the enforcement of environmental regulation. Additional analysis reveals that both lower expected cash flows and higher return volatility contribute to the negative market reaction. Existing environmental reporting policy mitigates, whereas the strength of formal and informal institutions, along with the enforcement of environmental regulation exacerbates the negative market reaction. Taken together, our study casts light on firms’ strategic reporting behavior of environmental pollution and underscores the important role that reliable and accurate information from a third party plays in facilitating the capital market price discovery.

Download paper14:00 - 16:00

Corporate Finance ( 12/18/2025 at 14:00 to 12/18/2025 at 16:00 )

Presiding : Tamara Nefedova (ESCP)

Room : ROOM 4

What are the costs of weakening shareholder primacy? Evidence from a U.S. quasi-natural experiment

Authors : Stulz Rene (The Ohio State University)

Presenter : Rene Stulz (The Ohio State University)

Discussant : Maxime Couvert (University of Hong Kong)

We study the consequences of weakening shareholder primacy using Nevada Senate Bill 203 as a quasi-natural experiment. A difference-in-differences analysis shows that, instead of improving their governance in response to the Bill to reassure capital providers, affected firms experience a governance deterioration. As a result, the Bill causes a drop in the valuation of firms incorporated in Nevada. The Bill has significant real effects through the investment channel, leading firms to make more but worse acquisitions and reducing the efficiency of capital expenditures and R&D. Weakening shareholder primacy does not improve how stakeholders are treated, as environmental and social performance worsens.

Download paperEXIM’s Exit: Industrial Policy, Export Credit Agencies, and Capital Allocation

Authors : Matray Adrien (Federal Reserve Bank of Atlanta) ; Muller Karsten (NUS) ; Xu Chenzi (NUS) ; Kabir Poorya (NUS)

Presenter : Adrien Matray (Federal Reserve Bank of Atlanta)

Discussant : Tomasz Michalski (HEC Paris)

We study the role of Export Credit Agencies—the predominant tool of industrial policy—on exports and firm investment by using the effective shutdown of the Export-Import Bank of the United States (EXIM) from 2015–2019 as a natural experiment. We document sizable real effects of the shutdown: a $1 reduction in EXIM trade financing reduces exports by approximately $4.50. EXIM-dependent firms experience a contraction in total revenues, investment, and employment. EXIM’s shutdown has the largest effects for exporters facing financing frictions and selling to markets with high contractual frictions, indicating that capital was allocated to markets that are plausibly under-supplied by private financial institutions. Consistent with these findings that EXIM addresses market gaps, we find that capital misallocation increased during the shutdown as firms with a higher ex-ante marginal revenue product of capital contracted more. These results provide a framework for the conditions under which Export Credit Agencies can boost exports and firm growth, and can act as a tool of industrial policy without increasing resource misallocation.

Download paperJudged by the Company You Acquire (Job Market Paper)

Authors : Gong Minrui (University of Mannheim)

Presenter : Minrui Gong (University of Mannheim)

Discussant : José M. Martin Flores (CUNEF Universidad)

Acquirers’ target choice can systematically reveal their technological gaps. I measure this gap as the similarity between the target’s technology and the technological frontier of the acquirer’s industry. Acquirers with larger gaps experience more negative market revaluations, as reflected in more negative announcement returns. This effect is present when the target is public, but not when it is private. These findings offer a new explanation for the observed disparity in acquirer returns between public and private targets: private targets are less transparent and therefore less likely to reveal the acquirer’s technological gaps, unlike their public counterparts.

Download paperWhere to Hire? CEO-Governor Political Alignment and Internal Labor Allocation

Authors : Zeng Linghang (Babson College) ; Wang Wanyi (Babson College)

Presenter : Linghang Zeng (Babson College)

Discussant : Jessica Jeffers (HEC Paris)

This paper studies how political alignment between a firm’s CEO and a state’s governor affects the firm’s internal labor allocation. We find that firms increase employment in states where the CEO is politically aligned with the governor. This effect remains robust when we exploit close gubernatorial elections as a source of plausibly exogenous variation in political alignment. The effect is stronger for firms with more politically polarized CEOs and in more recent years, consistent with rising political polarization. Further analysis suggests that the observed employment shifts are driven by CEO optimism about local policies and economic conditions, rather than by personal political preferences. However, we find that such politically motivated labor expansion is associated with lower stock returns in the following year. Overall, these findings indicate that political alignment with state governors shapes firms’ internal labor allocation decisions, though it may come at the expense of shareholder value.

Download paper14:00 - 16:00

Market Microstructure II ( 12/18/2025 at 14:00 to 12/18/2025 at 16:00 )

Presiding : Sophie Moinas (Toulouse School of Economics)

Room : ROOM 5

RFQ Dominance and Lit Trading in European ETFs: Peaceful Coexistence?

Authors : Marta Thomas (Wilfrid Laurier University) ; Dugast Jérôme (Université Paris Dauphine) ; Riva Fabrice (Université Paris Dauphine)

Presenter : Thomas Marta (Wilfrid Laurier University)

Discussant : Anna Calamia (Toulouse Business School)

We study Request-for-Quote (RFQ) trading in European ETF markets, where RFQs account for the majority of volume. Using granular trade-level data, we compare RFQs to lit executions through a spread decomposition framework. Price impact is consistently lower for RFQ trades, a result that holds under entropy balancing and matched-sample analyses. While price impact for lit trades increases with trade imbalance, RFQ executions are less sensitive to prevailing order flow. We also document a strong association between RFQ activity and ETF primary market flows. RFQs are widely used for institutional-sized execution with limited market impact and information leakage.

Download paperData-Driven Measures of High-Frequency Trading

Authors : Rzayev Khaladdin (University of Edinburgh and Koc University) ; Ibikunle Gbenga (The University of Edinburgh) ; Moews Ben (The University of Edinburgh) ; Muravyev Dmitriy (University of Illinois at Urbana-Champaign)

Presenter : Gbenga Ibikunle (University of Edinburgh)

Discussant : Fany Declerck (Toulouse School of Economics)

We introduce data-driven measures of high-frequency trading (HFT) that distinguish between liquidity-supplying and liquidity-demanding strategies. We train machine learning models on a proprietary dataset with observed HFT activity, then apply these models to public intraday data to generate HFT measures across all U.S. stocks during 2010-2023. Our measures outperform conventional proxies, which struggle to capture HFT’s temporal dynamics. Consistent with theory, our measures respond to a quasi-exogenous speed bump introduction and a data feed upgrade. The measures help uncover HFT’s differential impact on information acquisition. Liquidity-supplying HFT improves price informativeness around earnings announcements, while liquidity-demanding HFT impedes it.

Download paperCan preferred clearing reduce post-trade costs?

Authors : Alizadeh Bazrafshan Behnoud (University of Calgary) ; Alizadeh Bazrafshan Behnoud (University of Calgary) ; Zoican Marius (University of Calgary)

Presenter : Behnoud Alizadeh Bazrafshan (University of Calgary)

Discussant : Sylvain Friedrich (University of Bristol)

Preferred clearing mechanisms can yield lower equilibrium fees than full clearinghouse interoperability. We develop a simple model with two CCPs --- a leader and a follower --- and heterogeneous traders who choose a CCP and pay clearing fees. Under preferred clearing, trades settle on the follower CCP only when both counterparties are affiliated; otherwise, the leader CCP clears the trade. In equilibrium, strong network effects discipline competition and reduce fees, especially when high-frequency trading is prevalent. Incumbent CCPs opt for a preferred clearing system unless the share of high-frequency traders is sufficiently high, in which case they allow full interoperability with competitors.

Download paperEquilibrium VIX in Inelastic Markets

Authors : Menkveld Albert (Vrije Universiteit Amsterdam)

Presenter : Albert Menkveld (Vrije Universiteit Amsterdam)

Discussant : Jérôme Dugast (ESSEC)

On average, the squared VIX exceeds realized variance. This implies that investors pay a premium to hold variance risk. But, why pay for risk? And, why does the premium correlate with volume? In Grossman-Miller type inelastic markets, investors hold variance risk to hedge against liquidity shocks, because these shocks cause price pressures that add to realized variance. Therefore, a positive variance risk premium must emerge in equilibrium. This result is developed formally, and the model is calibrated to match empirical patterns in the variance risk premium and trading volume around eleven crises between 1993 and 2025.

Download paper14:00 - 16:00

Fixed Income (CDC INSTITUTE FOR RESEARCH) ( 12/18/2025 at 14:00 to 12/18/2025 at 16:00 )

Presiding : Jean-paul Renne (HEC Lausanne)

Room : ROOM 6

From Bonds to Dividend Strips: Decomposing the Equity Premia Term Structure

Authors : Goncalves Andrei (The Ohio State University) ; Andrews Spencer (Office of Financial Research)

Presenter : Andrei Goncalves (The Ohio State University)

Discussant : Alberto Plazzi (USI Lugano, Swiss Finance Institute)