Thursday, 16 December, 2021 - 13:30 to 19:30 Paris time

ONCE AGAIN THIS YEAR, FOR HEALTH REASONS (COVID-19), THE CONFERENCE HAS A VIRTUAL FORMAT USING ZOOM LINKS.

Presentation

The 19th edition of the Paris December Finance Meeting will be held online on December 16, 2021. The conference is organized by EUROFIDAI (European Financial Data Institute) and ESSEC Business School.

A special prize for the Best Paper of the Meeting will be awarded.

In 2021, a number of 481 papers were submitted for presentation at the meeting and only one out of 6 papers was accepted, indicating rigorous selection criteria.

The Paris December Finance Meeting is one of the top 2 European conferences in terms of selectivity and the quality of the papers presented.

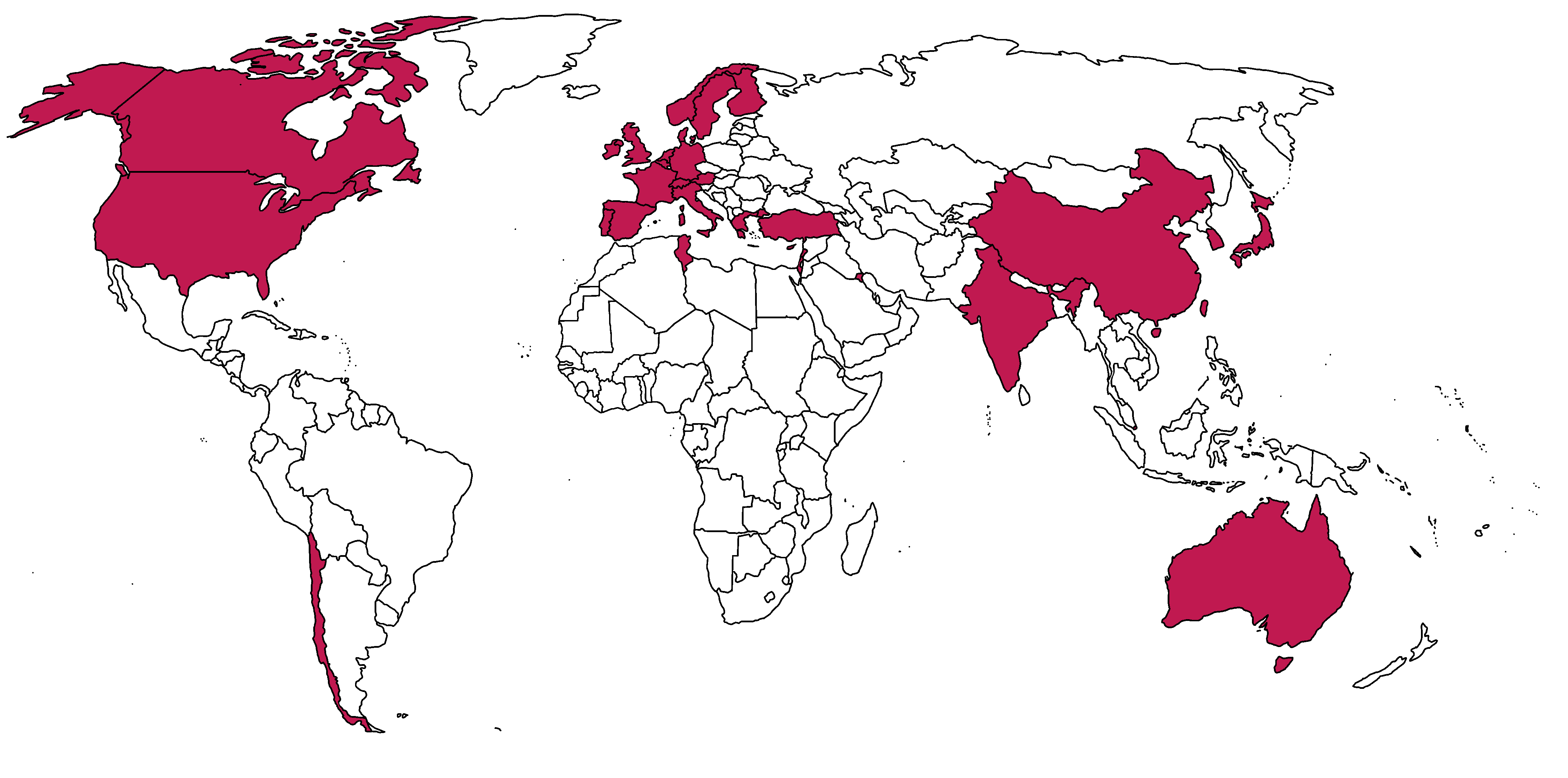

An international reach

In 2021, the submissions were received from :

The U.S (133), The U.K. (60), Germany (57), France (47), Canada (31), Switzerland (23), the Netherlands (22), China (19), Hong-Kong (17), Austria (14), Italy (11), Norway (8), Denmark (8), Brazil (4), Portugal (4), Sweden (4), Singapore (3), Israel (3), Luxembourg (3), Belgium (2), Finland (2), Russian Federation (2), Japan (1),Chile (1), Mexico (1), Turkey (1), Kazakhstan (1), Liechtenstein (1), Czech Republic (1), Spain (1).

Our sponsors

- Co-President : Patrice Fontaine (EUROFIDAI, CNRS)

- Co-President : Jocelyn Martel (ESSEC Business School)

2021 Scientific committee :

|

Yacine Ait-Sahalia Nihat Aktas Hervé Alexandre Charles-Olivier Amédée-Manesme Patrick Augustin Laurent Bach Anne Balter Romain Boulland Marie Brière Marie-Hélène Broihanne Catherine Casamatta Georgy Chabakauri Jean-Edouard Colliard Pierre Collin-Dufresne Ian Cooper Ettore Croci Serge Darolles Matt Darst Eric de Bodt François Degeorge Olivier Dessaint Alberta Di Giuli Christian Dorion Mathias Efing Ruediger Fahlenbrach Felix Fattinger Patrice Fontaine Pascal François Andras Fulop Jean-François Gajewski Edith Ginglinger Peter Gruber Alex Guembel Harald Hau Georges Hübner Julien Hugonnier Heiko Jacobs Sonia Jimenez Alexandros Kostakis Hugues Langlois Olivier Lecourtois Jongsub Lee Laurence Lescourret Abraham Lioui Elisa Luciano Yannick Malevergne Roberto Marfé Jocelyn Martel Maxime Merli Sophie Moinas Lorenzo Naranjo Lars Norden Clemens Otto Loriana Pelizzon Fabricio Perez Christophe Pérignon Joël Petey Ludovic Phalippou Alberto Plazzi Sébastien Pouget Sofia Ramos Jean-Paul Renne Tristan Roger Jeroen Rombouts Guillaume Rousselet Julien Sauvagnat Olivier Scaillet Mark Seasholes Paolo Sodini Christophe Spaenjers Ariane Szafarz Roméo Tédongap Erik Theissen Michael Troege Boris Vallée Philip Valta Guillaume Vuillemey Ryan Williams Rafal Wojakowski Alminas Zaldokas Olivier-David Zerbib Marius Zoican |

Princeton University WHU Otto Beisheim School of Management Université Paris Dauphine Université de Laval à Québec McGill University ESSEC Business School Tilburg University ESSEC Business School Amundi, Université Paris Dauphine, Université Libre de Bruxelles Université de Strasbourg TSE & IEA, Université de Toulouse 1 Capitole London School of Economics HEC Paris EPFL London Business School Universita Cattolica del Sacro Cuore University Paris-Dauphine Board of Governors of the Federal Reserve Université de Lille University of Lugano INSEAD ESCP Europe HEC Montréal HEC Paris EPFL & SFI WU Vienna University of Economic and Business EUROFIDAI - CNRS HEC Montréal ESSEC Business School IAE Lyon Université Paris-Dauphine University of Lugano Toulouse School of Economics University of Geneva - Swiss Finance Institute HEC Liège EPFL University of Duisburg-Essen Grenoble INP University of Liverpool HEC Paris EM Lyon Seoul National University ESSEC Business School EDHEC Collegio Carlo Alberto Université de Paris 1 Panthéon-Assas Collegio Carlo Alberto ESSEC Business School Université de Strasbourg Toulouse School of Economics University of Miami EBAPE/FVG Singapore Management University Goethe University Wilfrid Laurier University HEC Paris Université de Strasbourg Oxford University University of Lugano & SFI Toulouse School of Economics ESSEC Business School HEC Lausanne Université Paris 9 Dauphine ESSEC Business School McGill University Bocconi University University of Geneva & SFI Arizona University Stockholm School of Economics HEC Paris Université Libre de Bruxelles ESSEC Business School University of Mannheim ESCP Europe Harvard Business School University of Bern HEC Paris Oxera Surrey Business School HKUST Boston University University of Toronto |

The Online Meeting is ACTIVATED and only accessible to conference registrants.

AN ACCOUNT IS NECESSARY TO ACCESS THE ONLINE MEETING: Please click on "Create an account" if you have no account yet. Please make sure you use the correct username to identify.

ZOOM LINKS ARE NOW AVAILABLE. Please open each session to visualize each ZOOM LINK (one zoom link per session).